Are you tired of forgetting to pay bills on time and dealing with late fees? Do you struggle to keep track of all your monthly expenses? If so, a free printable bill checklist might be just the solution you need! With a bill checklist, you can easily organize all your bills in one place and stay on top of your finances with ease. Say goodbye to missed due dates and hello to financial peace of mind!

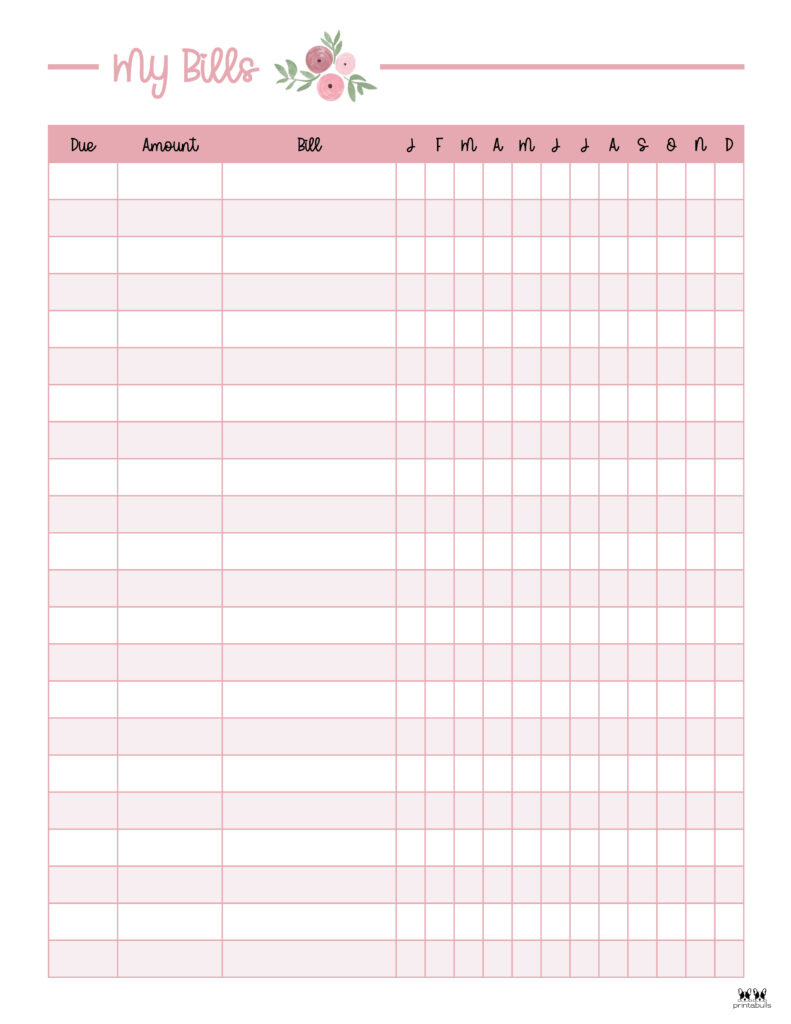

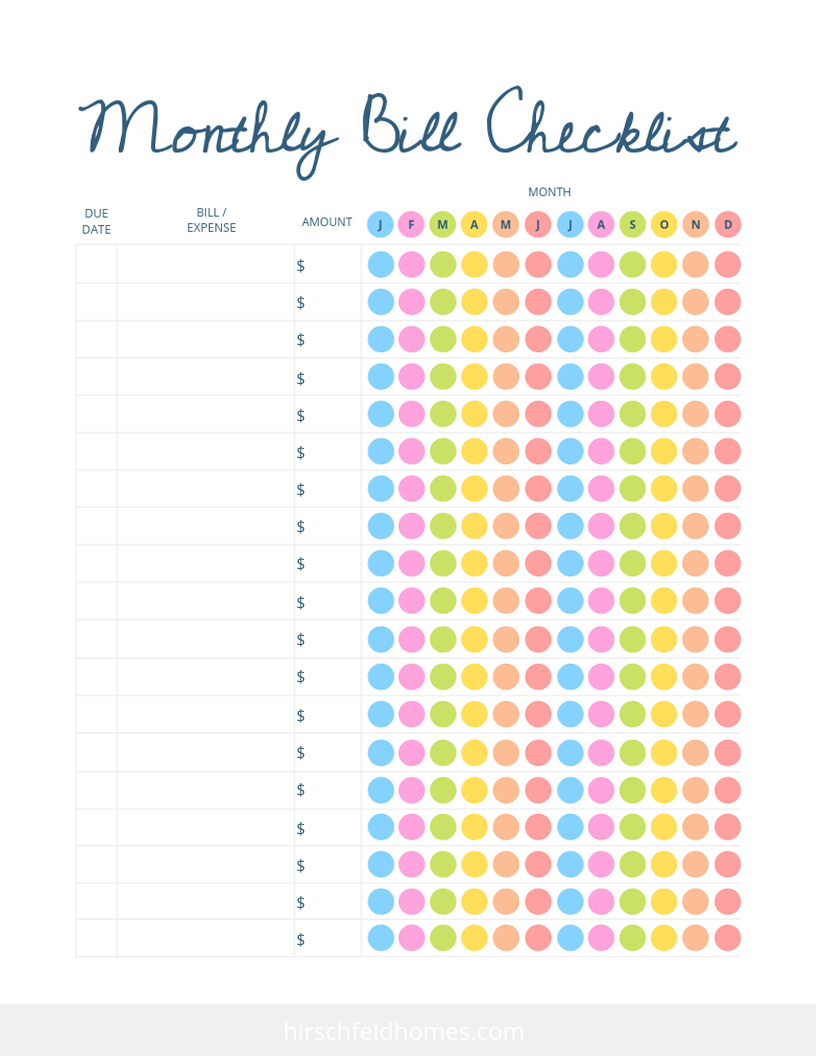

A bill checklist is a simple tool that can make a big difference in your financial management. By having a visual representation of all your bills, you can quickly see what needs to be paid, when it’s due, and how much you owe. This can help you prioritize your payments, avoid late fees, and ensure that you have enough funds to cover all your expenses each month. Plus, a bill checklist can serve as a helpful reminder of when to pay certain bills, so you never overlook an important payment again.

Stay Organized and Stress-Free

One of the biggest benefits of using a bill checklist is that it helps you stay organized and reduce stress. By having all your bills laid out in front of you, you can see exactly what needs to be paid and when. This can help you plan your budget more effectively and avoid any last-minute scrambling to cover unexpected expenses. With a bill checklist, you can feel more in control of your finances and less overwhelmed by the thought of managing your bills.

Additionally, a bill checklist can also help you track your spending patterns and identify any areas where you might be overspending. By seeing all your bills in one place, you can easily spot any recurring expenses that could be cut back or eliminated. This can help you save money in the long run and make more informed decisions about your financial priorities. With a bill checklist, you can take charge of your finances and work towards achieving your financial goals.

Customize Your Checklist to Fit Your Needs

Another great thing about a printable bill checklist is that you can customize it to fit your specific needs and preferences. You can add or remove categories, change the layout, or include additional information based on what works best for you. For example, you can color-code your bills based on priority or due date, add notes or reminders for each bill, or even create separate sections for different types of expenses. The flexibility of a bill checklist allows you to tailor it to your unique financial situation and make it as easy and convenient to use as possible.

Furthermore, a printable bill checklist can be easily updated and reused month after month. You can print out a new checklist at the beginning of each month or simply make changes to your existing checklist as needed. This makes it a practical and sustainable tool for managing your bills long-term. By using a bill checklist consistently, you can establish good financial habits, stay on top of your bills, and ultimately achieve greater financial stability. So why wait? Download a free printable bill checklist today and take the first step towards a more organized and stress-free financial life.

![]()